Start Buying Gold

Platinum

Silver

Secure Bullion Storage and Easy Accumulation of Gold, Platinum & Silver

Looking for a safe and convenient way to invest in precious metals? FirstGold™ offers a trusted solution for securely accumulating and storing 100% pure Gold, Platinum, and Silver bullion. Our innovative platform is designed for smart investors who want direct ownership and peace of mind.

With FirstGold’s physical bullion accounts, your precious metals are stored safely, fully allocated, and always accessible. Our user-friendly system lets you manage your bullion holdings effortlessly, with full transparency and unmatched security.

Start building and protecting your wealth today with FirstGold™ – the reliable choice for bullion investment and secure storage.

About Us

FirstGold: Australia’s Most Trusted Bullion Savings Plan:

Start investing in gold, silver, and platinum from just $50 with FirstGold — the pioneer of cost-averaging accumulation in Australia.

FirstGold is Sydney’s leading bullion partner, trusted by investors for secure and convenient access to physical gold, silver, and platinum bullion. Strategically located in the heart of Sydney, we specialise in helping clients protect and grow their wealth through reliable and transparent precious metals investment solutions.

With a strong reputation for award-winning customer service, FirstGold provides flexible, cost-effective bullion storage and accumulation options tailored to your investment goals. Whether you’re a first-time buyer or a seasoned investor, our secure platform makes it easy to buy, store, and manage your bullion portfolio with confidence.

Choose FirstGold – Sydney’s trusted name in bullion for safe, simple, and smart wealth growth.

Why Invest with FirstGold ?

Simple to use

- Save and accumulate as much or as little Gold, Platinum and Silver bullion as you choose

- Manage and control your bullion savings instantly online with a simple click

- Set up a personal or self-managed super fund account, or both

Safe and secure

- Open your free account immediately

- No entry fees, no exit fees, no hidden costs

- Easy options to save and sell Gold, Platinum and Silver, 24 hours a day

Physical is real

- 100% backed by physical Gold, Platinum and Silver bullion

- Fully owned by you at all times

- Bullion stored with a recognised vault company in Sydney CBD

"Put Gold First with FirstGold – The Smart Way to Safeguard Your Savings"

Grow your investments while you sleep.

Our FirstGold Founders

Simple, transparent, and secure platform. It’s investing like never before.

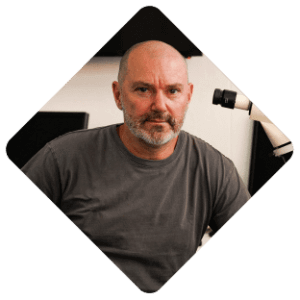

Michael Cohen

Michael Started his career serving an apprenticeship as a diamond cutter, polisher, cleaver and marker for a major DeBeers sightholder in South Africa. In the 1988, Michael then established a diamond cutting works (DCW) in Johannesburg CBD. The factory primarily traded in rough diamonds direct from the mine. The DCW situated in the city where Michael and his brother Roy manufactured polished diamonds, which are marketed around the globe. In 2001, the family migrated to Australia where the set up the DCLA, Australia’s first and only internationally accredited and endorsed Diamond grading laboratory.

Roy Cohen

Roy worked for Anglo American and De Beers, a multinational Diamond and Gold mining corporation, for several years before joining the DCW business in the 90’s. As an expert in rough and polished diamonds, and was active in the trading of rough diamonds and developing mining interests in the Kimberly area of South Africa and other African countries. Roy’s in-depth knowledge of Gold, Silver and he qualifications in the world of economics has been the backbone of the FirstGold platforms strategy and focus. An indispensable part of the consumers experience when dealing with FirstGold.

Dan Novick

Dan owned and operated a professional aviation business in Australia. Dan’s business expertise is extensive across many different companies, Including Gold, diamonds and other innovative technology companies. With a broad base of experience in marketing and commerce, and a passion for gold trading and the gold market, Dan is a hands on partner and leader. With his experience in selling gold, buying gold, Dan has earned the team an impeccable reputation in the trade around the globe.

What Our Customers Are Saying

Awards

Customer Service Standards and more

Faqs

What Others have wanted to know

Your physical Gold, Platinum and Silver bullion is deposited in a private vault owned and run by an internationally recognised vaulting company, with no ties to or under any control by FirstGold™.

Price includes all commission. All FirstGold purchases are 100% physical bullion. Available for collection at FirstGold on request with NO additional commissions or barring charges.

Controls provide assurance that the total amount of Gold, Platinum and Silver bullion in all FirstGold™ accounts is equal to the total ounces of physical bullion stored in the vault.

Controls also provide protection against the risk of unauthorised movement of bullion.

FirstGold™ strives for full transparency. Independent third party auditors are contracted to audit the vault and verify comprehensive reports about the ownership and the contents.

Gold and Platinum are delivered in one ounce bars, Silver is delivered in one kilogram bars. Delivery is available in other weights but may be subject to market related barring charges.

Collection is free of charge. If you wish for us to send you your Gold, Platinum and Silver bullion via a secure insured courier service, you will be quoted and charged a market rate for the secure courier service.

There is no need to withdraw any bullion from the vault before selling your Gold, Platinum and Silver bullion. The power of real savings is in your hands – you choose what you want to keep and what you want to sell. Using the FirstGold™ online dashboard, you can make a simple ‘‘sell’ transaction which directly controls the amount of Gold, Platinum and Silver bullion in your account. Payment is made into your nominated bank account.

Lloyd’s of London, the world’s specialist insurance market, provides full Metal Replacement insurance for the physical Gold, Platinum and Silver bullion stored in the vault. Your savings are secure.

You have complete legal ownership of all the Gold, Platinum and Silver bullion you accumulate in your FirstGold™ account. In the unlikely event that the FirstGold™ business ceases to operate, your Gold, Platinum and Silver bullion would be returned to you 100% with no loss incurred by you.

All Gold, Platinum and Silver Bullion traded by FirstGold™ is London bullion Market Association (LBMA) approved – Good Delivery Bars tradeable anywhere in the world.

If you are purchasing Gold, Platinum and Silver bullion on the FirstGold™ online system, then there is a spending cap of $5,000 per day. Purchases larger than $5,000 must either be staggered over multiple days online or, alternatively, a single transaction can be arranged over the phone with a FirstGold™ experienced staff member. To contact FirstGold™ staff, call 02 9020 5150. Ultimately, there are no other restrictions for the minimum or maximum amount of Gold, Platinum or Silver you can save.

If you have a Self-Managed Super Fund (SMSF) you will be able to invest in Gold, Platinum and Silver bullion for your superannuation, by opening a First Fold account. FirstGold™ meets Self-Managed Super Fund requirements related to insurance and security of your investment, giving you full flexibility.

When you buy Gold, Platinum and Silver bullion with FirstGold, you’re not just buying the simple bullion. You’re buying trust, security, and a guarantee for your future. The prices you see on our secure site for the purchase of gold and silver bullion are generated by two things. Firstly, we base all our prices on up-to-the-minute Gold, Platinum and Silver bullion spot prices from the international marketplace. Secondly, included in the price for your gold or silver is a small surcharge to cover incremental costs associated with Gold, Platinum and Silver bullion such as secure storage in our Custodian vault, insurance, management fees, as well as FirstGold™’s profit margin so we can keep providing you with the best possible service.

We base all our prices on up-to-the-minute Gold, Platinum and Silver bullion spot prices from the international marketplace. Since the gold and silver market is fluid, these prices are continuously updated. The amount of gold or silver you can save is based purely on these live Gold, Platinum and Silver bullion prices determining the dollar-to-ounce ratio.

The FirstGold™ online trading system also features a handy calculator, so you can gauge your buying power with minimal effort. The calculator will help you determine the amount of Gold, Platinum and Silver bullion you will receive based on the dollar amount you wish to invest on any particular day.

FirstGold™’s dollar-cost averaging method allows you to buy gold at the lowest possible price over the long term. Using dollar-cost averaging, you are able to buy more Gold, Platinum and Silver bullion when prices are low and less gold when prices are high, because you are buying a fixed dollar amount instead of buying Gold, Platinum and Silver bullion in terms of ounces. When you buy Gold, Platinum and Silver bullion in ounces, it remains the same amount no matter what the Gold, Platinum and Silver Bullion price is, but when you buy gold in dollar amounts, it results in you buying Gold, Platinum and Silver bullion at a lower average price because your dollars go further each month.

The buy rate is the only price you pay, which takes into account the live spot price of Gold, Platinum and Silver bullion as well as the USD/AUD exchange rate, FirstGold™’s profit margin, cost of insurance and storage. No additional costs are charged on collection.

A troy ounce of Gold, Platinum and Silver bullion equates to just over 31.1 grams.

FirstGold™ works on large volumes of Gold, Platinum and Silver bullion being invested and redeemed on a daily basis. This allows us to keep the margins low and our service level high.

FirstGold™ offers many easy options for getting in contact with our experienced staff. Call us during business hours on 02 9020 5150. Alternatively, you can email us at info@FirstGold.com.au or visit our offices in the Sydney CBD for a consultation!

You have full control over your bullion, including the power to take delivery of your Gold, Platinum and Silver bullion from the vault whenever you choose. See and feel what you own.