Gold prices dipped on Friday, tracking losses across the US stock market. According to analysts, some investors have been offloading gold to cover margin calls and losses in other asset classes.

Although gold is widely seen as a safe haven during times of uncertainty, it performs best when interest rates are low, as higher yields tend to make non-yielding assets like gold less attractive.

HSBC has revised its average gold price forecast upwards for 2025 and 2026.

These projections are up from their previous estimates reflecting concerns over rising geopolitical tensions.

Central banks are expected to continue buying gold this year and into 2026. However, HSBC cautions that demand may ease compared to peak levels seen between 2022 and 2024.

If prices climb buying could slow; conversely, should prices dip demand may increase.

Now is the time to Dollar cost average:

FAQs

Q1: What’s Standard Chartered’s gold price forecast?

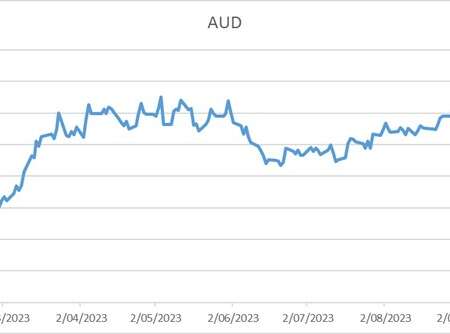

A1: Standard Chartered is forecasting gold to reach around AUD 5,400 per ounce in Q2.

Q2: Why is gold considered so valuable?

A2: Gold is prized for its ability to hold value during uncertain times.

It typically thrives in a low-interest-rate environment, where alternative investments offer lower returns.