Gold prices have fallen back below $3,400 an ounce as the conflict between Israel and Iran has not seen regional escalation. But while the precious metal continues its broader consolidation, commodity analysts at Bank of America say it still has a path to $4,000 an ounce.

In its latest report, the bank’s precious metals team, led by Michael Widmer stated that gold retains significant upside potential as investment demand has only just begun to grow. However, the analysts also cautioned that the chaos in the Middle East is not expected to provide sustainable bullish momentum for the yellow metal.

Although gold is a popular safe-haven asset, historically, event-induced demand has never proven to be sustainable. Some analysts note that gold is facing selling pressure at the start of the week, as the conflict has not impacted global oil supplies—an event that would typically drive oil prices higher, influencing inflation and global economic growth.

“When it comes to gold, wars are not always a clear-cut bullish price driver,” the analysts said. “The conflict adds, however, to the confluence of factors that have been supportive for the yellow metal.”

Rather than focusing on specific geopolitical events, Bank of America analysts are monitoring the broader economic landscape and gold’s growing appeal as an important global monetary asset.

This comes as U.S. government debt continues to grow at an unsustainable pace. Bank of America noted that gold is attracting new interest as Congress debates a new spending bill that aims to cut taxes—which is expected to increase the deficit by trillions of dollars.

“Market concerns over fiscal sustainability are unlikely to fade, regardless of the outcome of Senate negotiations,” the analysts said. “Rates volatility and a weaker USD should then keep gold supported, especially if the U.S. Treasury or the Fed is ultimately forced to step in and support markets. As such, while wars and conflicts are usually not sustained price drivers, we see a path for gold to rally to $4,000/oz over the next 12 months.”

Although gold appears a little crowded as prices have consolidated at elevated levels, Bank of America believes it still has room to grow.

“We estimate that investors have allocated 3.5% of their portfolios (including global equity, investment-grade, and high-yield debt exposure) to gold, which does not seem excessive and remains below the all-time highs of 2011,” the analysts said. “Meanwhile, central banks have continued increasing their allocations. Their holdings are now equivalent to just under 18% of outstanding U.S. public debt, up from 13% a decade ago.”

“That tally should serve as a warning to U.S. policymakers,” they said. “Continued apprehension over trade and U.S. fiscal deficits may well divert more central bank purchases away from U.S. Treasuries and into gold.”

If demand does remain stable, the analysts expect gold prices to continue consolidating between $3,000 and $3,500 an ounce.

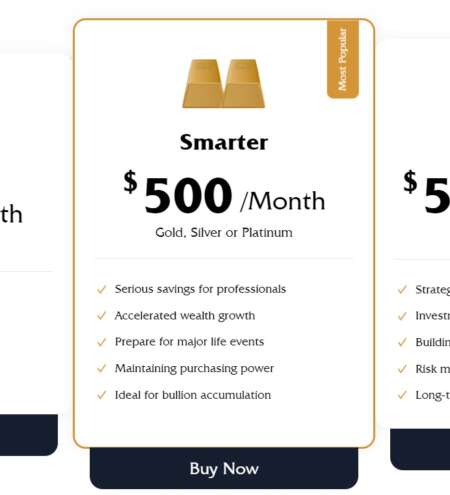

A final supportive factor for gold is the broadening rally in the precious metals sector, as silver and platinum have attracted new bullish momentum.

“Although silver had gone through a period of underperformance, the market has remained in deficit, mainly due to constrained mine supply. Hence, market participants have long anticipated a normalization in the gold-to-silver ratio, which has finally occurred, accompanied by an increase in assets under management at physically backed ETFs,” the analysts said. “We had a price objective of $40/oz for Q4 2025, so that rally arrived a bit earlier than we had anticipated, but we’re sticking with our forecast. If trade disputes normalize and global growth accelerates, silver should take another leg higher.”

Source: Neils Christensen Kitco