Gold is on a meteoric rise, shattering records by crossing US$3,000 an ounce earlier this month — marking a 14% year-to-date gain after a 27% rally in 2024. As the precious metal holds firm above this key level, could global growth and tariff uncertainties propel it even higher?

A Historic Surge

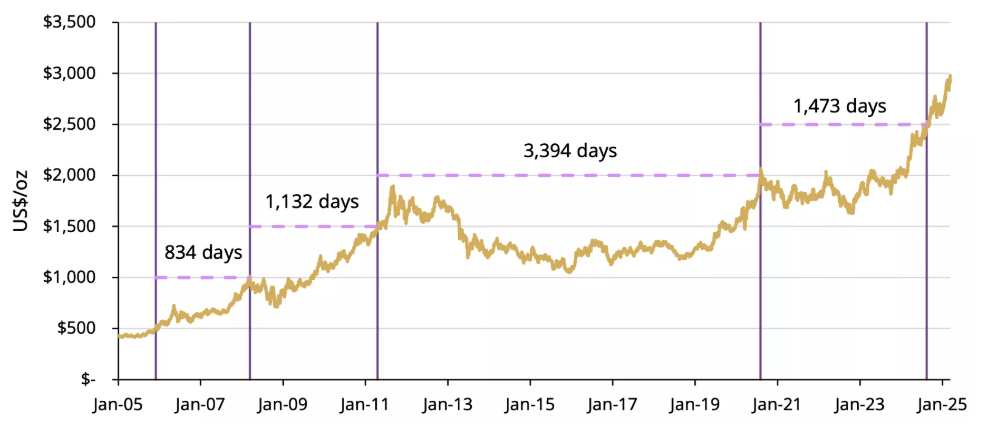

The World Gold Council (WGC) notes that gold’s recent rally defies historical norms. “On average, gold takes 1,708 days to climb $500 increments, but this latest jump took just 210 days,” says Taylor Burnette, WGC Research Lead. That said, the move from US$500 to US$1,000 requires a 100% increase, while the move from US$2,500 to US$3,000 is only a 20% rise.

Source: World Gold Council

To gauge this shift on a relative basis, Burnette examined gold’s deviation from its 200-day moving average: “The recent rally has pushed gold’s price three standard deviations above the long-term average spread of its 200-day moving average … following these moves there was a period of consolidation before the upward trend eventually resumed.”

What’s Next for Gold?

Historical data suggests gold typically trades above new $500 increments for nine days before retreating. “If gold sustains above US$3,000 for a few weeks, it could spark additional buying from derivatives contracts, potentially driving prices higher and triggering short-term profit-taking,” Burnette explains.

He cautions, however, that the rapid climb might lead to a near-term pause. “Despite short-term volatility, gold’s next move hinges on whether fundamentals can sustain its long-term trend.”

Insights from the Data

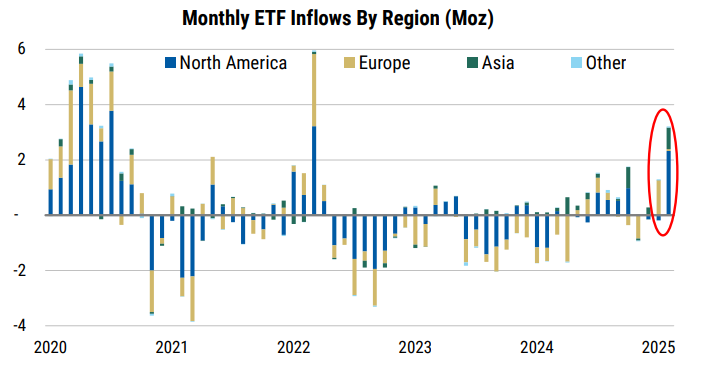

Morgan Stanley sees several factors favoring further gains. “Uncertainty tends to support demand for “safe haven” gold, whether that’s around global growth, tariffs or geopolitics. We think the shift in central bank behaviour is more structural and would expect another strong year of buying,” analysts noted on Tuesday. Yet they reiterate the WGC’s view, suggesting a period of consolidation may precede the next leg up. Demand trends paint a mixed picture. Central banks and global gold ETFs show strength in 2025, with China’s PBOC purchasing gold in January and February, and global ETFs recording their largest two-month inflow since the second quarter of 2022.

Global gold ETF flows are starting to return after a long streak of outflows in 2022-24 (Source: Morgan Stanley, World Gold Council).

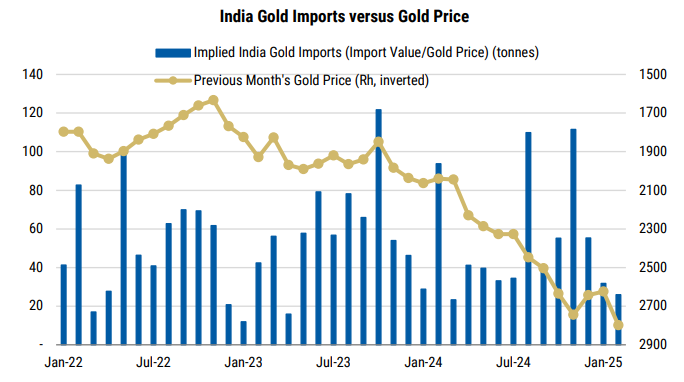

However, high prices are dampening jewelry demand. Morgan Stanley highlights a sharp drop in India’s imports in January-February — down over 50% from the December quarter despite the wedding season — signaling weakening demand in key markets.

Demand is weakening in regions like India as prices rise (Source: Morgan Stanley)

The bottom line: Morgan Stanley and the WGC suggest that gold’s era of easy gains may be behind us in the near term. While macro tailwinds—falling rates, a softening US dollar, and persistent uncertainty around tariffs, growth, and geopolitics — provide support, soaring prices could dampen jewelry demand. Overall, gold remains underpinned by fundamentals, but the path to further gains may be marked by volatility.

Written By Kerry Sun