The gold market has been very sideways in the early trading hours of Wednesday as we wait for the crucial FOMC statement, decision and of course, perhaps even more importantly, press conference. While traders are not necessarily expecting an interest rate cut or any type of movement during the day, the reality is that they will be parsing the statement and press conference answers for any signs as to when the Federal Reserve is going to start cutting, either explicitly or by suggestion.

Most market participants believe that the Federal Reserve will start cutting in September, but all things being equal, this is a market that short-term pullbacks I think are still buying opportunities, not only because of anything the Federal Reserve is doing, but the fact that we have multiple hot wars around the world and of course a trade war that is still very much going on. So, there’s a lot of chaos out there that might have people interested in owning gold for a bit of safety in their portfolio.

Experts trade the markets with IC Markets

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spread

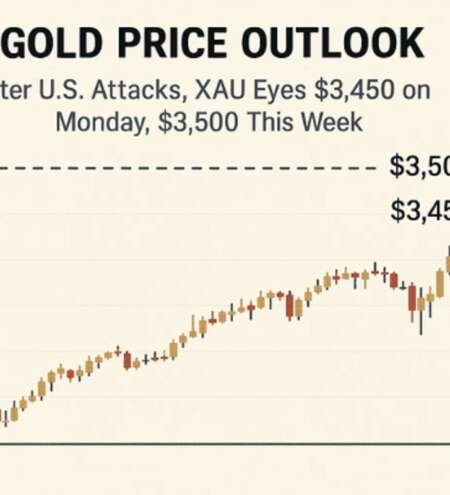

Pullbacks offer buying opportunities, especially near the $3,300 level. And again, at the 50-day EMA, if we can break above the $3,500 level, it’s likely that we will go looking at the $3,800 level, based on the measured move of the recent consolidation. I have no interest whatsoever in trying to short gold. I look at every pullback as a potential buying opportunity in what has been a very strong market for some time now.

Source: Fxempire