The gold markets rallied rather significantly during the course of the trading session on Tuesday in the early hours. We are well above the $2,900 level, and now it looks like we could make a run towards the highs again, right around $2,950. Breaking above there then opens up the possibility of reaching the target of $3,000, an area that I think a lot of people are aiming for anyway. And of course, an area that I think when we get there will attract a lot of headlines, probably options, trading, et cetera.

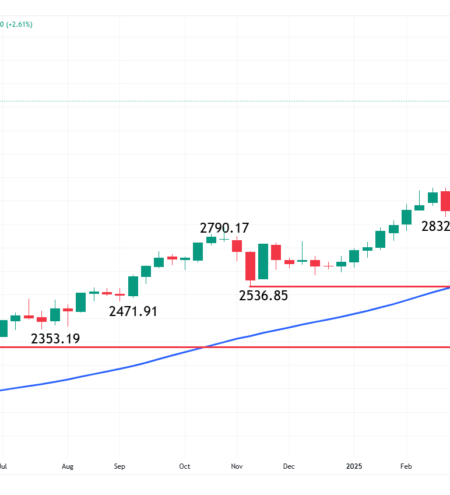

So, with all of this, I remain bullish long-term, and I look at gold as a market that when it does fall, it’s offering value. The 50-day EMA sits just above the $2,800 level and I think that is a support level as well. So, it’s really not until we break down below that region that I would be concerned about the overall uptrend.

Experts trade the markets with IC Markets

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spread

Given enough time, I think that any short-term pullback ends up being a buying opportunity that you must take advantage of. The US dollar has been softening in the early hours of the market, that of course helped. Plus, we have a lot of concerns out there when it comes to tariffs and what that might do to the global economy. Beyond that, we have geopolitical concerns. After all, there is a land war in Europe at the moment that seems like it could get worse actually. And now we have gold as a safety asset at the moment functioning exactly how you would expect it to.

Source: Fxempire