The gold price rallied in the last hours and now trades at $2,163. The precious metal has dropped slightly in the short term, but the bias remains bullish.

Fundamentally, the XAU/USD turned to the upside as the US Prelim UoM Consumer Sentiment, Capacity Utilization Rate, and Empire State Manufacturing Index came in worse than expected.

Today, Chinese industrial production rose 7.0%, beating the expected 5.3% growth. Retail Sales registered only a 5.5% growth, less than the 5.6% growth forecasted. Unemployment Rate jumped unexpectedly from 5.1% to 5.3%, while Fixed Asset Investment came in better than expected. Furthermore, the Eurozone Final CPI and Final Core CPI matched expectations, while the Trade Balance was reported higher at 28.1B above the 14.2B estimated.

The BOJ and the RBA are expected to keep the monetary policy tomorrow, but the press conferences should move the markets.

In addition, the Canadian Consumer Price Index may announce a 0.6% growth after only a 0.0% growth in the previous reporting period. The FOMC and the UK CPI represent high-impact events on Wednesday that remain pivotal for the gold.

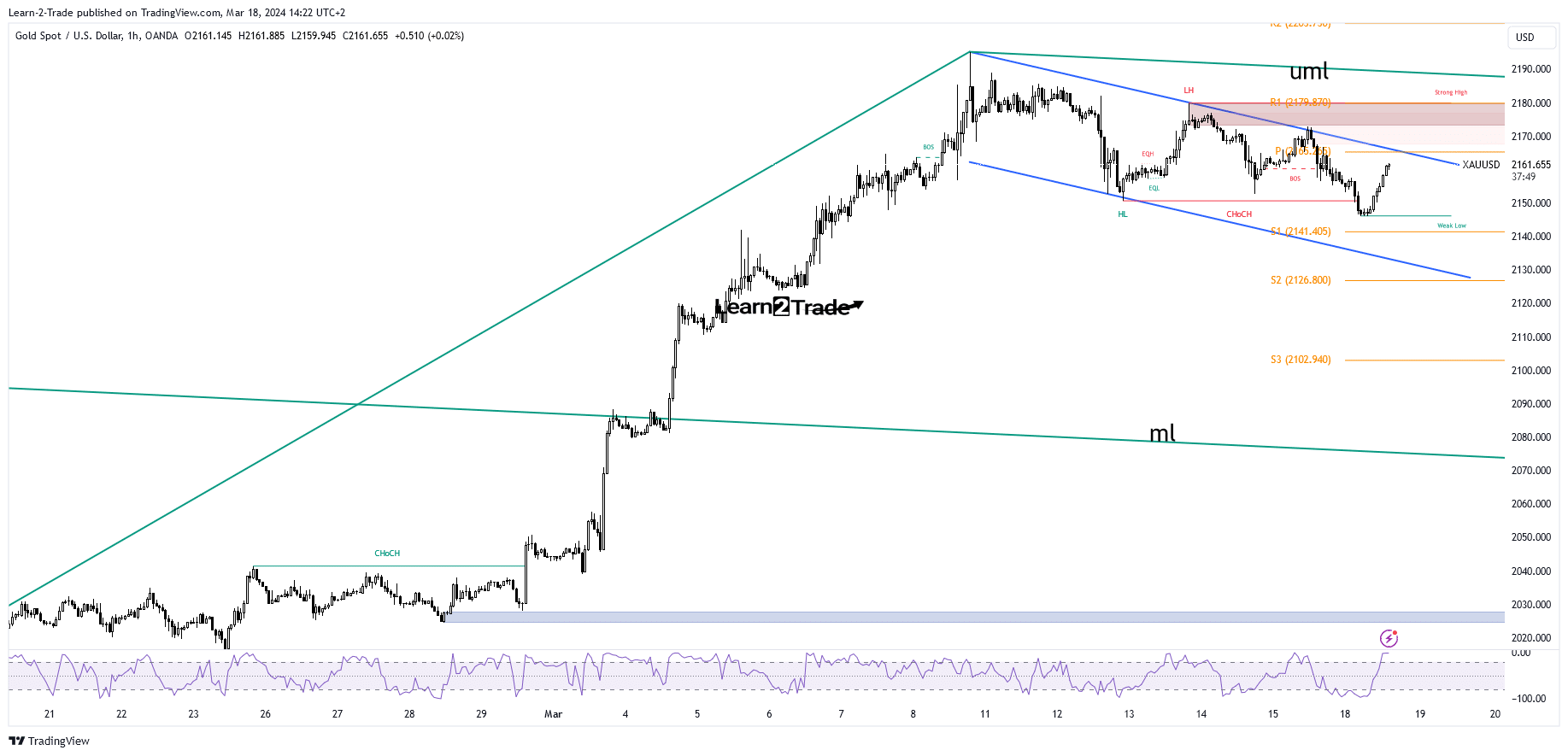

Gold Price Technical Analysis: Down Channel

Technically, the XAU/USD dropped within a down-channel pattern. It could print a more extensive correction if it stays below the downtrend line.

The weekly pivot point of $2,165 stands as a static resistance. The price could try to test the resistance levels in the short term.

We have a vital confluence area at the intersection between the pivot point and the downtrend line. A valid breakout activates further growth, while false breakouts may announce a new sell-off.

Source: forexcrunch