Precious metals prices could be in for another standout year, with gold expected to reach a potential high of $3,290 per ounce in 2025, while silver prices could top $43.50, while the outlook for platinum group metals (PGM) appears more constrained, according to the results of the 2025 LBMA Annual Precious Metals Forecast Survey.

“This year’s forecast has seen bullish price forecasts submitted by analysts, who collectively expect gold to outperform 2024 with an average price of $2,736.69 – 14.7% higher than the average price for 2024 ($2,386.20), and just $51 lower than the record gold price for 2024 ($2,788.54 – AM auction, October 30),” the report noted. “A wide forecast trading range, however, indicates analysts are expecting significant price volatility. Furthermore, no analyst has forecast an average price above $3,000, but 20 analysts see a high price of $3,000 or above.”

Forecasts for this year’s LBMA survey were submitted by participating analysts before the close of business on January 13, 2025, giving the 30 analysts the opportunity to observe eight days of trading before sharing their predictions.

“Gold is forecast to trade between $2,250.00 (the lowest low) and $3,290.00 (the highest high) this year,” the LBMA said. “This trading range of $1,040.00 is significantly larger than the 2024 range forecast of around $624, suggesting some price volatility is expected this year.”

The most bullish prediction came from Keisuke (Bill) Okui of Sumitomo Corp, who forecasted an average gold price of $2,925 per ounce for 2025. The most bearish forecaster was Robin Bhar of Robin Bhar Metals Consulting, who predicted an average price of $2,500.

Turning to the silver outlook, the participating analysts expect the gray metal will once again follow in gold’s footsteps this year, with an average forecast price of $32.86, which is 16% higher than the average 2024 price of $28.27.

“This optimistic stance is backed up by expectations of continued strong industrial and investment demand, and silver’s habit of treading a similar path to gold, a metal for which analysts have high hopes this year,” the LBMA said. “Furthermore, concerns over a growing supply and demand imbalance and monetary policy easing by central banks all point to continued increased investor interest.”

“With price expectations between $24.00 (lowest low) and $43.50 (highest high) – a range of $19.50 – a volatile trading range is anticipated,” they added. “In fact, the highest high forecast for 2025 of $43.50 by Debajit Saha (London Stock Exchange Group) is 26% higher than the highest actual price for silver in 2024 of $34.51 (23 October).”

The most bullish full-year prediction for silver came from Nicky Shiels of MKS PAMP SA, who projected the gray metal’s price to average $36.50 per ounce this year. “Silver is to outperform all precious metals in 2025 given synchronised central bank rate cuts, a more supportive China and US macroeconomic backdrop, still strong solar demand, and ultimately a lower US dollar trajectory,” Shiels said in her commentary.

At the other end of the spectrum, ABC Refinery’s Nicholas Frappell delivered the most bearish silver forecast with an average price of $28.25.

On platinum, the LBMA said the forecasts “reveal low expectations, with an average price predicted by the analysts of $1,021.64 – just $65 greater than the actual price average for 2024, revealing a similarly bearish sentiment to the 2024 forecast.”

“The lacklustre forecasts for platinum reflect the expectation that the platinum market will soften as supply is forecast to grow faster than demand,” they added. “And with few significant new industrial applications on the horizon and investor interest remaining moderate, driving prices higher will be challenging.”

Meanwhile, the total trading range for platinum prices is forecasted to be $550, which is lower than the actual trading range of $872 in 2024.

The most bullish experts on platinum were Julia Du of ICBC Standard Bank and Joni Teves of UBS, both of whom submitted both average forecasts of $1,100 per ounce in 2025.

The most bearish prediction for platinum prices came from Capital Economics’ Kieran Tompkins, who expects to see an average of $920.

“The rollout of electric vehicles (EVs) will weigh on demand for platinum,” Kieran said in his full commentary. “Admittedly, the take-up of EVs in the west is in the midst of stalling and greater use of hybrid vehicles will be supportive of platinum. But EV sales in China have surged and, in any case, even non-EV sales are unlikely to strengthen much amid interest rates staying higher for longer, limiting any boost to platinum demand.”

And the LBMA said it was a similar story for palladium prices. “Analysts reflect concerns of oversupply and weak demand growth for palladium, with an average forecast of $991 – barely scraping above the actual average for 2024 of $983, which itself was a large drop from the 2023 average price of $1,337.39.”

“Analysts’ forecasts for 2025 reveal that palladium prices will likely be hampered by concerns of oversupply and weak demand,” they added. “However, a few analysts do wonder whether the palladium market is broadly balanced given palladium demand is dropping, mine production is easing – and whether the bad news is already baked into the current price.”

Joni Teves of UBS was also the most bullish on palladium, predicting an average price of $1,090 per ounce this year. “Palladium prices are likely to continue consolidating within a broad range, with scope for interim spikes,” Teves said in her commentary. “Demand should stabilise over the next couple of years before resuming modest declines.”

The most bearish forecast – an average price of $906 through 2025 – belonged to Rhona O’Connell of Stonex Financial Ltd.

Key 2025 drivers: the Fed, sovereign demand, and geopolitics

Analysts were also asked to identify their three top drivers for the price of gold in 2025. The top three drivers were identified as US Fed policy (28%), central bank demand (21%), and geopolitical risks/uncertainty (15%).

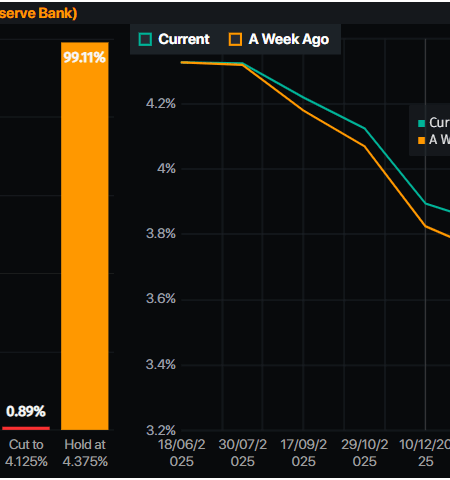

“As identified by the analysts, the Fed’s activity in 2025 could hold the key to gold’s fortunes,” the report said. “If the Fed raises interest rates, this could put downward pressure on gold prices. On the other hand, if rates are lowered or if the Fed maintains a dovish stance to support economic growth, it could make gold more appealing as an alternative investment, potentially driving prices higher.”

“If the Fed signals concerns about rising inflation and takes action to combat it, gold prices could rise as investors seek protection from currency devaluation,” the LBMA added. “If the Fed’s policies are perceived as too loose and inflation expectations rise, gold may also benefit.”

Chantelle Schieven of Capitalight Research was among the most bullish analysts on gold, with her $2,875 per ounce average ranking third among all respondents. “Many of the same factors that drove the gold price higher in 2025 will likely also be positive for gold in 2025,” Schieven said in her commentary.

Nicky Shiels of MKS PAMP SA shared an average forecast of $2,750, which was just above the median forecast of $2,732.50. “Gold prices at $3,000+ or $2,500- is contingent on whether the Fed is ahead or behind the ‘Trumpflation’ curve,” Shiels wrote.

After Fed policy, central bank demand was seen as the second-most important driver for gold prices in 2025. “Central bank buying significantly increases demand, positively impacts market sentiment, and speculative activity further drives up prices,” the LBMA noted.

“Geopolitical risks are likely to stay elevated with Trump’s return to the White House unlikely to be a calming influence, which could see central banks, especially those in emerging markets, continue to add gold to their reserves at a brisk rate,” said Bloomberg’s Grant Sporre, who predicted an average gold price of $2,727 per ounce in 2025.

In regard to geopolitical instability, the LBMA noted that in times of trouble, gold becomes even more valuable. “From the beginning of February 2024 – the month during which the conflicts in Ukraine and the Middle East gained pace – to the end of March, the gold price saw an 8% increase in the gold price – from $2,045.85 to $2,214.35 (LBMA PM prices),” the LBMA said.

“Furthermore, in the broader commentary, there were no fewer than 33 mentions of US President Donald Trump, citing concerns over geopolitical instability, trade policies and relations, and how Trump’s tenure may result in gold continuing to uphold its reputation as a safe haven asset,” they added.

Source: Ernest Hoffman Kitco