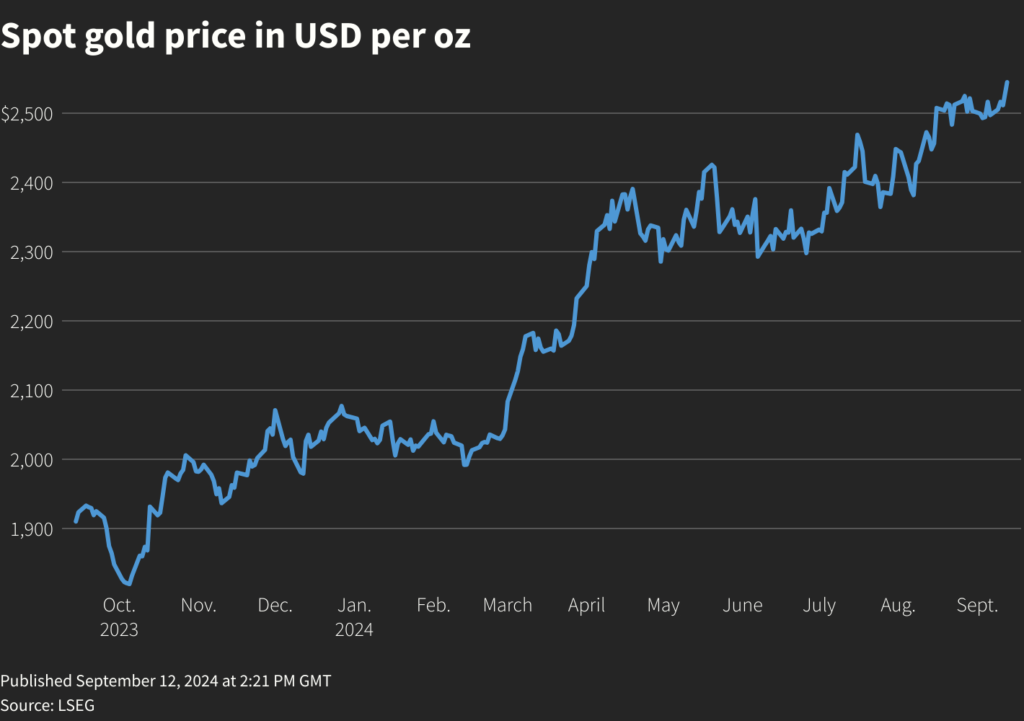

Gold prices hit a new record on Thursday after the latest set of US inflation and unemployment figures helped bolster the the chances of a Federal Reserve cut next week.

Spot gold climbed 1.6% to a new all-time high of $2,554.78 per ounce, before falling to below $2,500 as of noon ET. Three-month US gold futures were 1.5% higher at $2,580.40 per ounce.\

While the producer price index for August was higher than economist forecast, rising 0.2% instead of 0.1% over the previous month, the over the overall trend remained consistent with subsiding inflation.

On the same day, the US Labor Department released data showing initial jobless claims increased by 2,000 to 230,000 in the week ended Sept. 7, just above economist expectations.

Both the US Treasury yields and the dollar dipped after the readings, boosting bullion’s appeal to investors.

“We are headed towards a lower interest rate environment so gold is becoming a lot more attractive… I think we could potentially have a lot more frequent cuts as opposed to a bigger magnitude,” Alex Ebkarian, chief operating officer at Allegiance Gold, said in a Reuters note.

Markets are currently pricing in an 85% chance of a 25-basis-point US rate cut at the Fed’s Sept. 17-18 meeting, and a 15% chance of a 50-bps cut, the CME FedWatch tool showed.

“The labor market is continuing to falter and if the labor market deteriorates, the journey that they’ll embark on in cutting rates is going to go for an extended period of time,” said Phillip Streible, chief market strategist at Blue Line Futures.

ECB lowers rates

Earlier Thursday, the European Central Bank lowered interest rates for the second time this year with inflation receding toward 2% and concerns about the economy building. That pushed the euro higher against the greenback, weighing on a gauge of the dollar strength.

“A cocktail comprising an ECB rate cut, small pickups in jobless claims and PPI has been enough to send gold to a fresh record high,” Ole Hansen, head of commodities strategy at Saxo Bank, told Bloomberg.

Swap traders have cemented wagers on a quarter-point reduction by the Fed at its meeting next week after Wednesday’s consumer product index picked up in August.

For the gold market, “the beginning of a rate cutting cycle is likely to add support,” regardless of the size of the cut, Hansen added. Lower rates are typically positive for non-interest yielding bullion.

Source: mining.com