Gold has set another all-time high as expectations for Federal Reserve rate cuts grow while some traders ramped up bets on a second Donald Trump presidency.

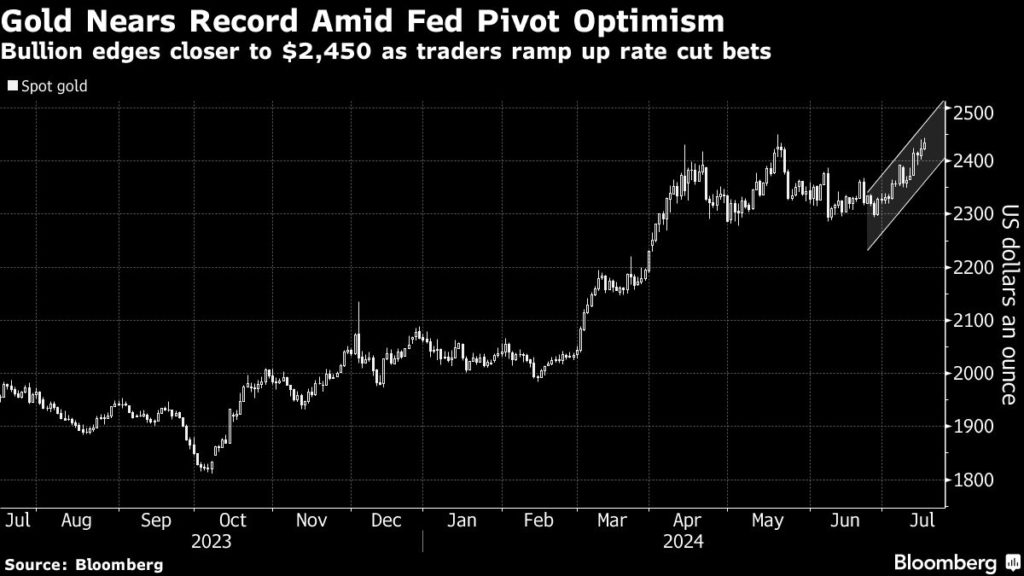

Spot gold was up 1.7% to $2,464.39 an ounce by 2:15 p.m. ET, having earlier hit a new record of $2,466.02 an ounce. US gold futures also surged 1.7% to $2,470.10 an ounce in New York.

Bullion is now almost 20% higher for the year, boosted by anticipation of Fed loosening as well as significant buying by central banks. Geopolitical tensions have also supported the metal that is traditionally seen as a safe-haven asset.

“Optimism about US interest rate cuts as more economic data supports the case for a Fed pivot is supporting gold,” Ewa Manthey, a commodities strategist at ING Bank NV, said in a Bloomberg note on Tuesday.

“Gold is poised to keep its positive momentum going amid the current global geopolitical and macroeconomic landscape, while central bank demand is expected to grow,” Manthey added.

On Monday, Fed Chair Jerome Powell said recent data had given policymakers greater confidence that inflation is heading down to the central bank’s 2% goal.

Traders have been adding bets there will be three cuts this year after Goldman Sachs said conditions were ripe for easing, with “a solid rationale” for officials to lower rates as soon as July.

Gold’s latest rally isn’t unexpected: in June, consultancy Metals Focus predicted a fresh record this year, while earlier this month Citigroup said its base case for gold in 2025 was $2,700-$3,000 an ounce.

Trump momentum

Trump’s presidential candidacy gained momentum after a failed assassination attempt over the weekend and a judge dismissed a criminal case against him.

However, a Trump presidency could have potentially positive and negative impacts on gold, according to Giovanni Staunovo, a commodity analyst at UBS Group AG. It might lead to “tax cuts, supporting a shift to equities, and eventually limiting faster rate cuts,” he warned.

On the other hand, tax cuts would impact US fiscal balances, potentially weakening the dollar’s status and pushing buyers toward safe-haven assets such as gold, Staunovo said.

Source: mining.com