Gold and silver prices are firmer in early U.S. trading Tuesday, with gold flirting with its recent all-time highs. More safe-haven and chart-based buying are featured in the two precious metals this week. April gold was up $8.40 at $2,957.40. March silver prices were last up $0.077 at $33.45.

There is increased speculation the U.S. might revalue its gold reserves from the current $42 an ounce (last valued in 1973), to today’s spot gold price. Broker SP Angel reports, “There is suggestion of this enabling the U.S. Treasury’s ability to borrow under the debt ceiling, pushing the ‘Xdate’ of debt renegotiation back.” Meantime reports say Elon Musk is calling for an audit into the Fort Knox gold reserves, currently stated at 4,580 tons. “Increased awareness of the potential value of gold is likely supporting inflows to the metal. ETF inflows are ticking up as gold continues to gain traction with retail investors,” said SP Angel.

Asian and European shares were mixed in trading overnight. U.S. stock indexes are set to open weaker when the New York day session begins. The U.S. stock indexes are not far below their record highs scored late last year.

In overnight news, U.S. President Donald Trump said he would probably impose tariffs on auto, semiconductor and drug imports of around 25%, with an announcement coming as soon as April 2. Trump did not specify which countries would be affected. The U.S. trade tariff uncertainty, and its global economic ramifications, continue to drive safe-haven demand to gold.

U.S. Secretary of State Rubio told European allies the U.S. will keep sanctions on Russia in place at least until a deal is reached to end the Russia-Ukraine war. Trump said he’ll probably meet Russian President Vladimir Putin to discuss a peace deal before the end of this month.

The U.S. data point of the day is the minutes from the latest FOMC meeting.

The key outside markets today see the U.S. dollar index modestly higher. Nymex crude oil futures prices are firmer and trading around $72.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently at 4.56%.

Other U.S. economic data due for release Wednesday includes the weekly MBA mortgage applications survey and new residential construction.

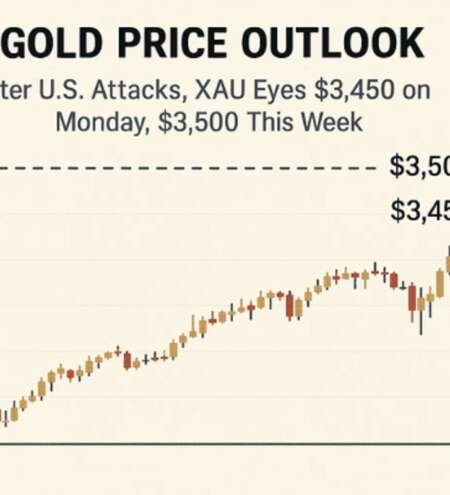

Technically, April gold futures bulls have the strong overall near-term technical advantage. Prices are trending up on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $3,000.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,850.00. First resistance is seen at $2,968.50 and then at $2,985.00. First support is seen at $2,925.00 and then at $2,900.00. Wyckoff’s Market Rating: 9.0.

March silver futures bulls have the firm overall near-term technical advantage amid a price uptrend in place on the daily bar chart. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the February high of $34.24. The next downside price objective for the bears is closing prices below solid support at last week’s low of $31.65. First resistance is seen at $34.00 and then at $34.25. Next support is seen at $33.00 and then at this week’s low of $32.46. Wyckoff’s Market Rating: 7.0.

Source: Jim Wyckoff Kitco