Gold prices are trading higher on the first trading day of the year as investors continue to remain optimistic on the back of the potential Fed’s monetary policy moves. Gold price staged decent gains in 2023 as the price surged whopping 13% and investors and traders believe that the price can easily continue its surge this year.

Background

Gold prices have started to rise mainly due to the optimism that the Fed will adopt a more dovish tone and monetary this year. It is widely anticipated that the Fed will lower the interest rates by at least 100 basis points this year. The base rate in the US is 5.5% while it was 4.5% same time last year this time. In the after math of covid which flared up inflation in the US, the Fed increased the interest rates 11 times but they didn’t move any muscle in the recent meetings.

During their most recent FOMC Minutes, it was clear to a large extent that the Fed is done with its interest rates and in 2024 we will see the Fed lowering the interest rate. This particular factor boosted the price of gold and many believe that real rally is about to begin.

Price Action

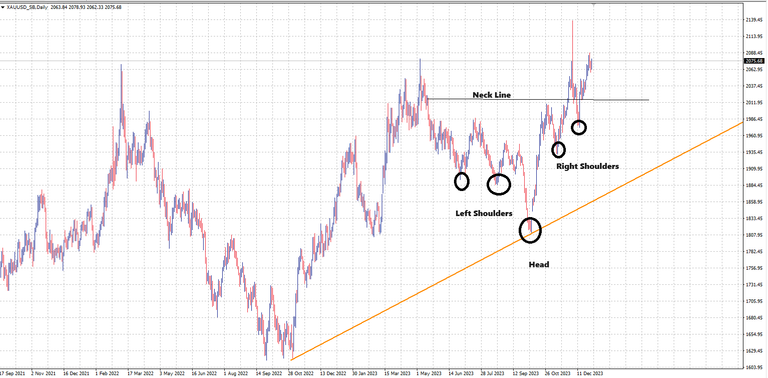

The gold price chart below shows that the price is trading pretty much close enough to it’s all time high and the price the price has respected its uptrend line. In addition, the price has also formed a complex reverse head and shoulder pattern (these are with two shoulders and the right shoulders are higher than each other and also above the left shoulders) as one can see it on the chart and if the price completes this patterns projection, the gold price could easily cross above its all time and we could see the shining metal trading well above the 2,200 price mark.