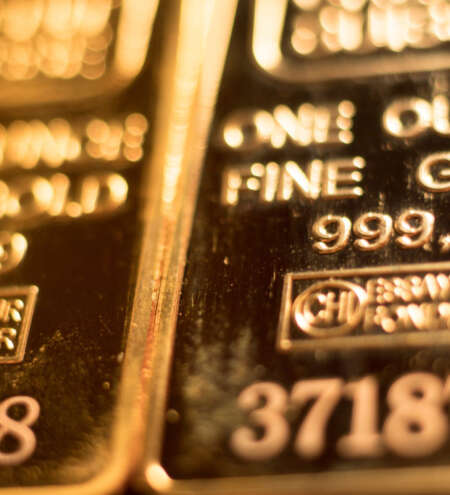

Technical momentum is supporting gold prices near a two-week high above $1950 an ounce as the precious metal sees little reaction to significantly disappointing housing construction data, highlighting ongoing weakness in the U.S. housing sector.

Housing starts dropped sharply by 11.3% to a seasonally adjusted annual rate of 1.283 million units last month, the Commerce Department said on Tuesday.

The data came in weaker than expected as economists looked for a drop to 1.44 million units. At the same time, July’s data was revised lower to a rate of 1.447 million units from the previously reported 1.45 million units.

For the year, housing construction is down more than 14% compared to activity in August 2022.

The gold market is seeing little reaction to the disappointing economic data as technical momentum keeps prices supported above a key psychological level. December gold futures last traded at $1,956.80 an ounce, up 0.17% on the day.

The U.S. housing sector remains a significantly weak pillar of the economy as persistently higher prices and elevated mortgage rates due to the Federal Reserves’s aggressive tightening cycle has pushed many new home buyers out of the marketplace; however, there are some signs that the market is starting to stabilize at lower levels.