Gold Prices Soar to Record $3,000 per Ounce Amid Economic Uncertainty

The price of gold has surged past the $3,000 per ounce milestone for the first time, driven by heightened demand as economic uncertainty grips global markets amid escalating trade tensions.

On Friday, gold reached an all-time high of $3,004.86 per ounce, marking a 14% increase since the start of 2025. The precious metal is traditionally regarded as a safe-haven asset, attracting investors in times of financial instability.

Ongoing trade disputes between the United States and its key trading partners have unsettled markets, raising concerns over economic growth and consumer spending worldwide.

The introduction of tariffs—taxes imposed on imports—has fuelled fears of rising inflation, prompting investors to turn to gold. When tariffs are levied on imported goods, businesses often face increased costs, which are then passed on to consumers, further driving up the cost of living.

On Thursday, US President Donald Trump announced a proposed 200% tariff on alcohol imports from the European Union (EU), escalating the trade conflict. This move was in retaliation to the EU’s plans to impose a 50% tax on US-produced whiskey, a response to Trump’s sweeping tariffs on all steel and aluminium imports into the US.

Additionally, the US has raised tariffs on Chinese imports to a minimum of 20%, further exacerbating global trade tensions.

“In an environment of geopolitical uncertainty and shifting trade policies, demand for gold remains robust,” said Suki Cooper, a precious metals analyst at Standard Chartered.

Victoria Hasler, head of fund research at Hargreaves Lansdown, highlighted two key factors driving gold prices.

“Between Trump’s tariff policies, his unpredictable social media pronouncements, and ongoing conflicts in the Middle East and Russia-Ukraine, uncertainty is at elevated levels and continues to rise,” she noted.

“Markets abhor uncertainty, and this has contributed to gold’s record-breaking rally.”

Another significant driver has been central bank purchases of gold, though the precise motivations remain uncertain. “It is likely that part of the reason is a move to diversify reserves away from the US dollar,” Hasler added.

“Both of these factors remain in play, and I don’t see them easing any time soon.”

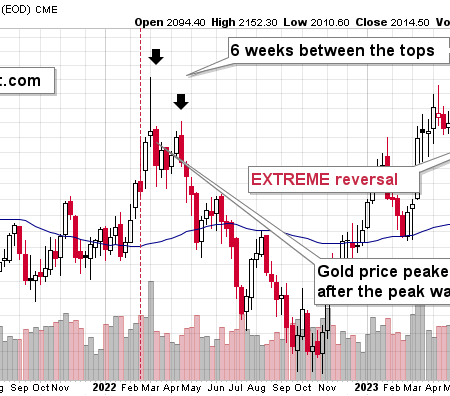

Historically, gold price peaks and troughs have coincided with major economic events. During the 2007 global financial crisis, investors flocked to gold as a safe-haven asset, pushing its price higher.

Russ Mould, investment director at AJ Bell, cited World Gold Council data showing that central banks accumulated 1,045 tonnes of gold last year—the third consecutive year in which purchases exceeded 1,000 tonnes.

“We are in an era where gold is truly shining,” Mould stated.

Since falling below $1,200 per ounce in late 2018, gold prices have steadily climbed, influenced by multiple factors including the Covid-19 pandemic and rising government deficits, which have made investors more inclined to seek refuge in gold.

“Determining the primary catalyst behind gold’s resurgence is challenging,” Mould added. “Trump’s tariffs have sparked debates on their potential inflationary—or even stagflationary—effects, and their implications for funding the new US President’s planned tax cuts.”

With uncertainty unlikely to subside in the near future, gold’s appeal as a safe-haven asset looks set to persist.