Gold prices climbed sharply on Tuesday, rising over 2% to approach the US$3400 mark per ounce. The rally was fuelled by a combination of renewed weakness in the US Dollar and a bold move by China to internationalise its gold market—a development that may reshape global trading dynamics.

With Shanghai and London markets reopening after the May Day holiday, investors were quick to respond to news that China will now allow gold held in international vaults to be used to settle contracts on the Shanghai Gold Exchange (SGE). This step could pave the way for more foreign participation and more seamless cross-border trading in the world’s largest gold-consuming nation.

This initiative is part of a wider “Action Plan” launched by the People’s Bank of China, encouraging the SGE to expand its reach globally. A key part of the plan involves opening a new gold vault in Hong Kong, operated by a subsidiary of Bank of China—one of the country’s largest commercial banks and a founding member of the London Bullion Market Association.

Why This Matters to Gold Investors

Gold rose nearly $100 on Monday alone, with US markets driving the gains while both London and Shanghai remained shut. When Shanghai reopened on Tuesday, its benchmark gold price jumped 1.8% to over ¥792 per gram. That pricing now carries a premium of over $50 per ounce compared to London quotes—more than six times the usual import incentive—signalling robust demand within China.

Beijing’s push comes amid growing global scepticism of the US Dollar, especially following years of tariff-driven uncertainty and geopolitical tension. According to the Bank of Communications, weaponisation of trade policy by the US has driven global investors to seek safer, more neutral alternatives, boosting the appeal of Yuan-denominated assets.

The Shanghai Gold Exchange originally opened its international platform (SGEI) in 2014, allowing holders of the offshore Yuan (CNH) to trade gold in Shanghai’s free-trade zone. While trading initially soared, interest faded despite fee waivers and incentives. Today, most of the international board’s volume is minimal and dominated by Chinese banks.

China’s Influence on Gold Prices is Growing

What’s becoming increasingly clear is that China is no longer just a passive participant in global gold markets—it’s a driving force. According to Goldman Sachs, many of gold’s sharpest price moves in recent weeks have coincided with the opening of Chinese markets, with trading on the SGE and the Shanghai Futures Exchange now playing a larger role than even the US Comex in driving short-term price action.

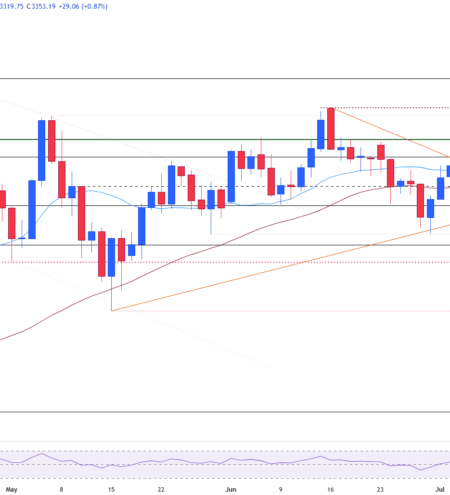

While Tuesday’s Shanghai fix remains about 4.5% below its all-time high of ¥830 set in April, and London’s benchmark still trails its $3433 peak, gold remains firmly in a bullish posture. Prices in British Pounds and Euros are also just off record highs.

Key Takeaway

For gold investors, China’s moves signal more than just short-term volatility—they mark a structural shift in how the gold market operates. The growing influence of the Yuan, expanding international access to China’s bullion infrastructure, and rising premiums in Shanghai all point to a changing centre of gravity in the global gold market.

Stay alert. As China rewires the rules of the game, opportunities—and risks—will emerge for those positioned to navigate this evolving landscape.