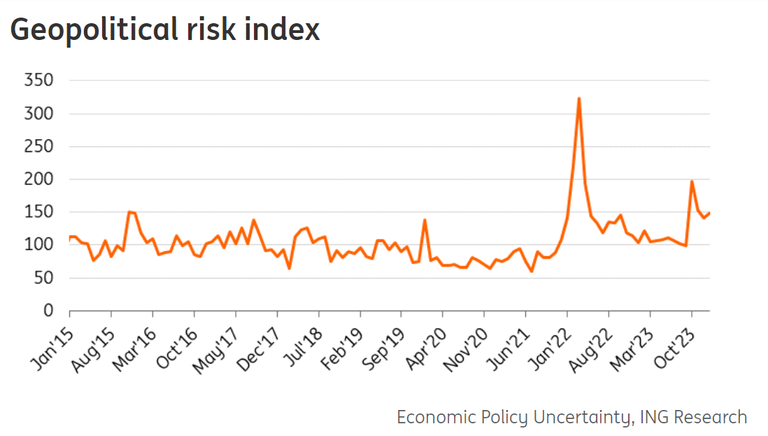

Geopolitical tensions are supporting gold, but the Fed’s monetary policy pivot will remain the key driver for prices in 2024, according to Ewa Manthey, Commodities Strategist at ING.

“Ongoing geopolitical risk in Ukraine and the Middle East continue to provide support to gold. Prices hit an all-time high of $2,077.49/oz on 27 December 2023,” Manthey said. “Still, we believe the Federal Reserve’s wait-and-see approach will keep the rally in check.” She expects an average gold price of $2,025 per ounce over Q1 2024.

Manthey said ING believes the Federal Reserve’s interest rate policy will continue to determine the outlook for gold prices in the months ahead.

“Strong GDP and jobs growth show that the US economy continues to shrug off high borrowing costs and tight credit conditions, largely through robust government spending and consumers running down their savings,” she said. “These factors will be less supportive in 2024 and inflation is on the path to 2%, so the Fed has the room to cut interest rates sharply. Our US economist still expects the Fed to start cutting rates in May.”

She added that ING is pricing in significant volatility in the coming months “as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.”

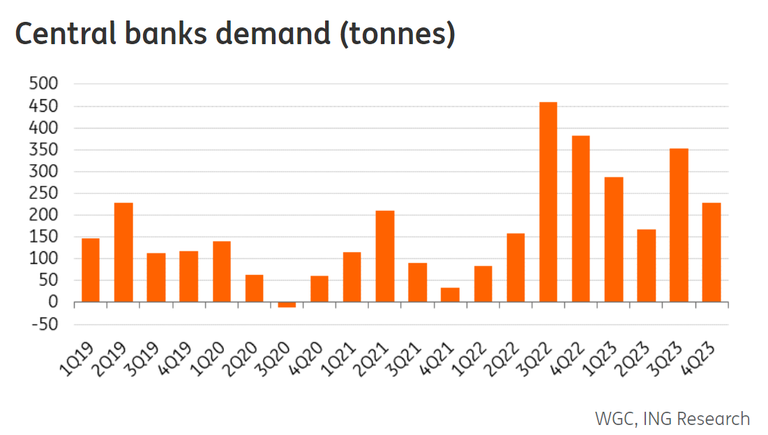

The ING strategist also noted the continued strong demand for gold from central banks after 2023 saw annual net demand of 1,037 tonnes, less than 50 tonnes below the all-time record of 1,082 set in 2022.

“Central banks’ healthy appetite for gold is also driven by concerns about Russian-style sanctions on their foreign assets, following a decision from the US and Europe to freeze Russian assets and shift strategies on currency reserves,” she said. “Gold tends to become more attractive in times of instability and demand has been surging over the past two years, with the trend showing few signs of abating. We believe this is likely to continue this year amid geopolitical tensions and the current economic climate.”

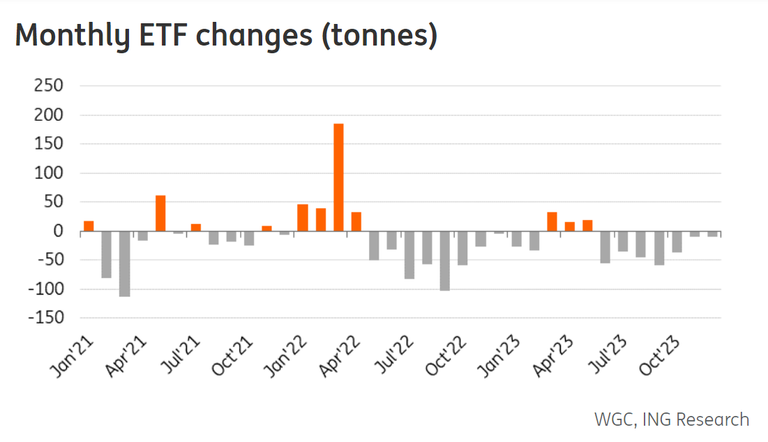

Manthey pointed out that gold-backed ETF holdings have also continued their 2023 trend, as they declined again in January for the eighth consecutive month. “This was equivalent to a 51-tonne reduction in global holdings to 3,175 tonnes by the end of January,” she said. “With the bets on early rate cuts from major central banks being pushed back, investors’ interest in gold ETFs faded. Looking further ahead, however, we believe we will see a resurgence of investor interest in the precious metal and a return to net inflows given higher gold prices as US interest rates fall.”

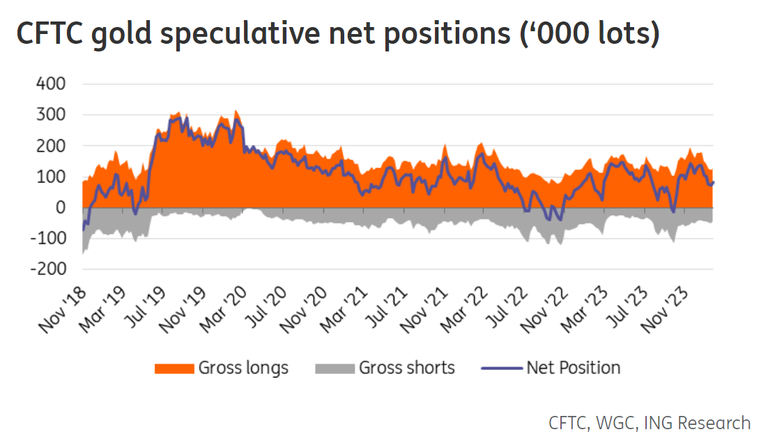

“The latest positioning data from the CFTC reflecting sentiment in the gold market showed that managed money net longs in COMEX gold increased by 10,615 lots following four weeks of decline to 82,591 lots as of 6 February 2024,” Manthey noted. “The move higher was driven by falling gross shorts by 6,376 lots.”

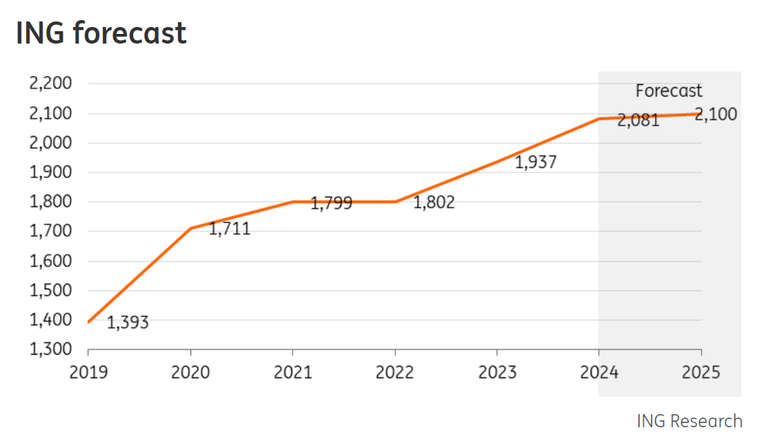

She concluded by saying that ING still expects to see new all-time highs for gold prices this year.

“We think they’ll average $2,150/oz in the fourth quarter and $2,081/oz in 2024 on the assumption that i) the Fed starts cutting rates in the second quarter, ii) the dollar weakens, and iii) safe haven demand continues amid global economic uncertainty,” Manthey said.

“Downside risks revolve around US monetary policy and dollar strength,” she said. “The higher-for-longer narrative could see a stronger dollar for longer and weaker gold prices.”

Source: Ernest Hoffman Kitco