Gold prices (XAU/USD) remained subdued during Tuesday’s Asian trading session, consolidating near $3,321.61 per ounce. Mixed market signals are shaping sentiment, including speculation around the Federal Reserve’s next rate move, muted U.S. trade policy developments, and heightened global tensions.

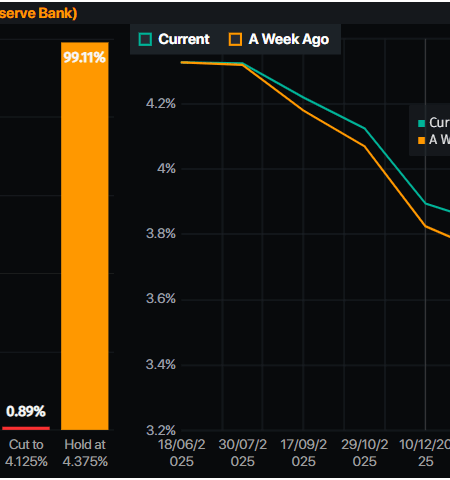

The U.S. dollar index slipped 0.3% to a one-month low, making dollar-denominated gold more appealing to foreign investors. Market participants now anticipate at least two 25-basis-point Federal Reserve rate cuts by year-end, driven by recent softer inflation data and slowing economic indicators.

Experts trade the markets with IC Markets

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spread

“Gold is caught in a tug-of-war between a weaker dollar, potential Fed easing, and geopolitical risks,” said Kelvin Wong, senior market analyst at OANDA Asia Pacific.

Former President Trump’s decision to delay the imposition of 50% tariffs on European Union imports until July 9 provided short-term relief to market nerves, but the broader trade outlook remains uncertain. The combination of muted dollar strength and cautious Fed guidance is keeping gold prices in check.

Silver Finds Support Near $33.22 but Faces Resistance

Silver (XAG/USD) mirrored gold’s consolidation, trading around $33.50 per ounce. The ongoing uncertainty surrounding U.S. fiscal policy and trade negotiations is a key backdrop.

The Congressional Budget Office projects the federal deficit will expand by $4 trillion over the next decade, driven by proposed tax cuts and spending initiatives. This has raised concerns over longer-term dollar stability, indirectly supporting silver’s price floor.

Investors Eye Key U.S. Data and Fed Signals

Market participants are now focusing on upcoming economic reports for guidance. Tuesday’s Durable Goods Orders and Consumer Confidence Index will provide short-term cues, while Wednesday’s FOMC minutes and Friday’s Personal Consumption Expenditures Price Index are expected to shape expectations for the Fed’s rate path.

As geopolitical tensions persist and economic signals remain mixed, gold and silver prices are likely to stay range-bound, supported by safe-haven demand but constrained by limited bullish momentum.

Short-Term Forecast

Gold and silver prices may hover near support levels as traders watch upcoming U.S. economic data and Fed signals, with volatility driven by persistent macro uncertainties and mixed sentiment.

Gold (XAU/USD) has pulled back from its recent climb, slipping to around $3,321.61 as buyers lose momentum near the upper boundary of the rising channel. The price action reveals a clear rejection from resistance levels near $3,340, with the 50-period EMA at $3,319 acting as short-term support.

A break below this level could open the door to the $3,309 and $3,277 zones. The overall structure remains bullish, supported by the channel and higher lows, but the failure to hold above key support levels raises caution.

Traders should watch for a decisive move: a recovery above $3,340 with bullish confirmation could signal a resumption of the uptrend, while a breakdown below $3,309 might indicate a deeper correction.

Silver (XAG/USD) has slid below its rising trendline support on the 2-hour chart, currently trading near $33.22. The break below the $33.28 trendline, which had provided a base for recent upward moves, signals a potential shift in momentum.

The price is also sitting just below the 50-period EMA ($33.22), adding to the pressure. Immediate support is seen around $33.01, while a deeper dip could test $32.85. On the upside, $33.40 and $33.70 remain key resistance levels. If silver recovers above the trendline, it might reclaim lost ground, but for now, the tone looks cautious.