The upcoming FOMC meeting with new dot plots for U.S. interest rates and Iranian parliamentary elections could make March a pivotal month for the yellow metal, according to the latest gold market commentary from the World Gold Council (WGC).

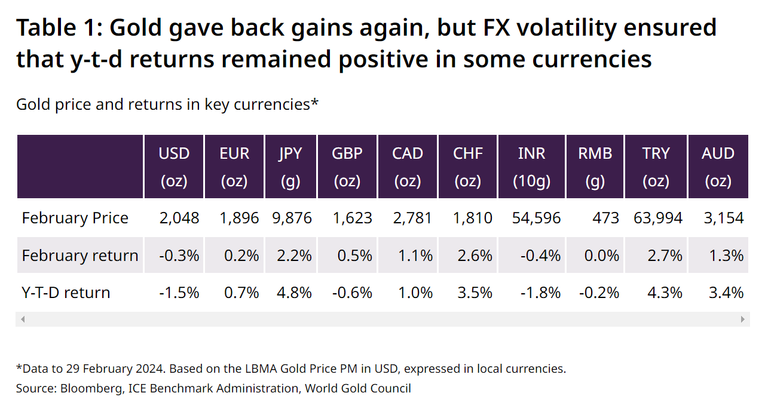

“Gold prices retreated to US$2,048/oz by the end of February, a 0.3% m/m fall,” they noted. “Nonetheless FX volatility has ensured that y-t-d returns remain positive in four of the major currencies.”

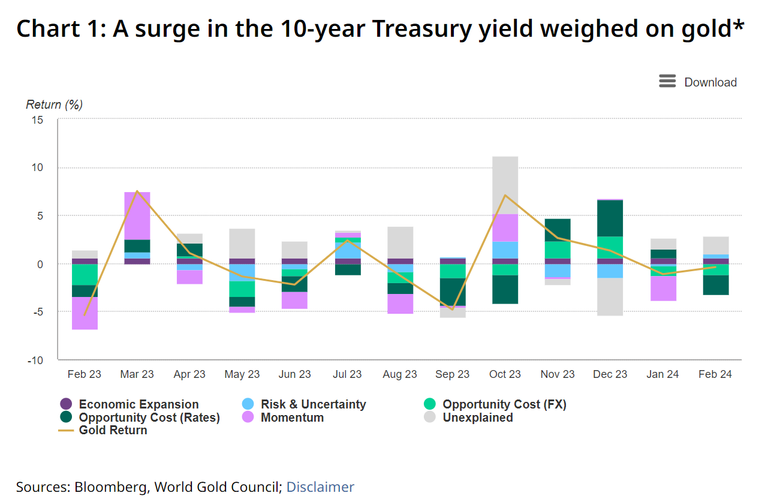

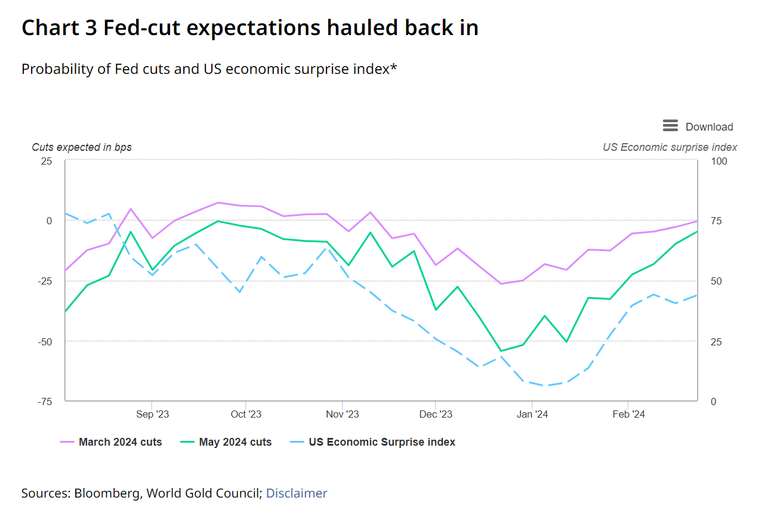

“As per our Gold Return Attribution Model (GRAM), a sharp move higher in the US 10-year Treasury yield (+34bps) appeared to be the major culprit in driving gold lower – understandable given the barrage of positive inflation and economic surprises over the past two months,” they said.

The analysts pointed out that “aggressive risk-on positioning” from the ongoing outperformance of the so-called Magnificent Seven equities and the NVIDIA-led AI frenzy also sapped interest in gold last month. “But the gold price staged a comeback on the last day of February, since when it has moved above US$2,100/oz.”

Looking ahead at the rest of the month, WGC analysts flagged two key events that could prove pivotal for gold prices, one in the Middle East and the other in the United States.

“Iran’s parliamentary elections shouldn’t in themselves create waves, but the country’s consumers are major gold buyers and their elections could pave the way for an important political secession,” they wrote.

The other major event is the upcoming March FOMC meeting, which the WGC believes is particularly important, even though markets aren’t expecting any movement on rates, as it will “provide investors, following a slew of strong data, with the first set of dot plots since December’s dovish tilt,” they said. “Even though markets have priced out a cut, the argument for is as vehement as the argument against. Uncertainty reigns in monetary policy.”

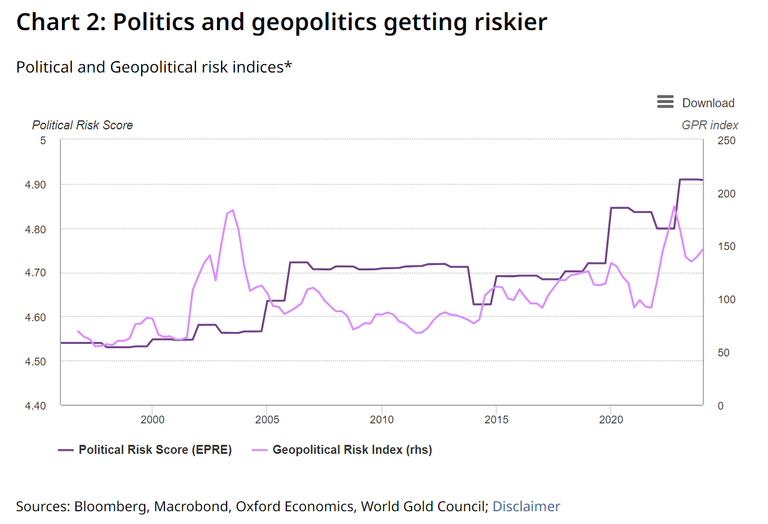

Gazing further out, the Council noted that “2024 is peppered with political event risk” as a slew of important elections have the potential to redraw the political map. “Some of these elections have cross-border implications, increasing the overlap between politics and geopolitics, and that matters to investors,” they wrote.

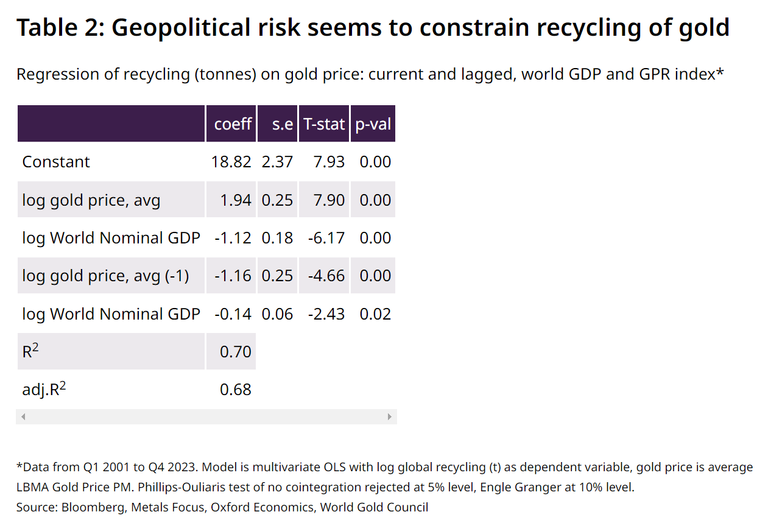

“As we have noted previously, geopolitical risk seems to have a significant impact on gold prices,” the analysts said. “But this is not just via the investment channel. Anecdotally in 2023, gold holders – in the Middle East and Europe in particular – were less willing to give up their gold in the face of high prices and economic distress. Adding the geopolitical risk index (GPR) to an equation for global recycling suggests it adds a significant restraint to supply from this sector.”

The WGC estimates that recycling fell by 30 to as much as 70 tonnes in 2023. “It seems therefore that geopolitical risk matters – broadly – and prompts us to keep a keen eye on elections over the next few months as we gauge what they could mean for gold,” the analysts wrote.

They noted that there was going to be an election in Ukraine this month in addition to the Iranian one, but the former canceled theirs.

“Iran’s parliamentary vote – for two legislative bodies – is likely to usher in little change in a country where voter antipathy is high,” they said. “But one of these bodies might prove pivotal, both inside and outside Iran. The Assembly of Experts has one important job – to choose a new Supreme Leader. At a ripe 84, Khamenei’s secession is probably nigh.”

The WGC believes the Iranian elections could be important to gold investors for a number of reasons.

First, “Iran is the sixth largest buyer of jewelry, bar and coin,” they said. Secondly, “Khamenei is a known quantity and a successor may bring further uncertainty to a region already mired in it.”

And finally, “Iran is reportedly reluctant to directly involve itself in the issues currently taking place in the Middle East, but actions of proxy militias raise the risk that it will be drawn in,” they noted. “As the third largest producer of oil in OPEC+ it carries a latent marginal risk to the global price of oil and consequent inflationary and geopolitical repercussions.”

Aside from the geopolitical variables, the Federal Reserve remains the biggest driver of gold prices on the March docket, and the WGC thinks that recent events across the pond make this upcoming meeting more interesting.

“On Tuesday 20 February the Bank of England (BoE) governor, Andrew Bailey, stated that the BoE rate cuts don’t require inflation at target,” they wrote. “A bold statement from one of the major central banks and fodder for doves. Yes, the UK just experienced a statistical recession and pain is being more viscerally felt in the household sector here than in the US, but it could embolden rate doves, with investors having unwound almost all of their rate-cut bets since January.”

“Whether the Fed heeds the wishes of other central banks or the market – both unlikely – is another thing,” the analysts said.

“But to add to the confusion, the Fed can be unpredictable,” they noted. “The dovish pivot in December, even as strong inflation and economic data tumbled in, proved that second guessing the Fed can be a gamble.”

They said that given the incongruities of the December meeting, the updated dot plots will be of particular interest. “Does the Fed backtrack on its dovish turn in December? Will the wide dispersion in the dots narrow? Will the market show more restraint than it did following the December meeting?”

The Council analysts said they continue to believe that rate cuts will come this year and recession risks remain under control. “But even if policy rates come down, long maturity yields are not destined to follow,” they said. “Does that bode ill for gold? Not necessarily. The two key buyers in 2023: central banks and emerging market retail investors, are not particularly wedded to long maturity US yields. Furthermore, a failure of yield drop, aided by a run-down in the Fed’s Repo facility (RRP), could be a continued symptom of higher-term premia, not rosy growth expectations. This was reflected at times during 2023 as a reluctance by investors to absorb Treasuries given worrying underlying fiscal and debt dynamics.”

The WGC concluded by noting that while the Iranian election and FOMC meeting aren’t expected to signal imminent change, “Relative calm in volatility measures (MOVE for bonds and VIX for equities) suggests surprises could elicit strong market moves.”

They added that the sudden gold rally to multiple new all-time highs at the beginning of March “suggests a market itching for a trigger, aided by recent strong reported Chinese demand, a quietly bullish sell-side gold forecasts and weaker US ISM numbers on 1 March.”

Source: Ernest Hoffman Kitco