Federal Reserve Chair Jerome Powell confirmed on Wednesday that he still expects the central bank to reduce interest rates this year, despite the fact that inflation hasn’t reached its 2% target yet. While inflation data started to drift down towards the end of 2022, January indicated that prices rose briskly and could pose a threat ahead.

Powell stated that the Fed is waiting for more data showing a sustainable decrease in inflation before moving to lower interest rates. However, he did acknowledge that interest rates are at their highest point for this economic cycle. The stronger-than-expected economy at the beginning of 2024 has pushed back the anticipated start of rate cuts, originally thought to be possible this month but now expected in May or June.

One factor the Fed considers is the strength of the job market. January saw the creation of 353,000 new jobs, and investors are awaiting the Labor Department’s report on February employment, due on Friday.

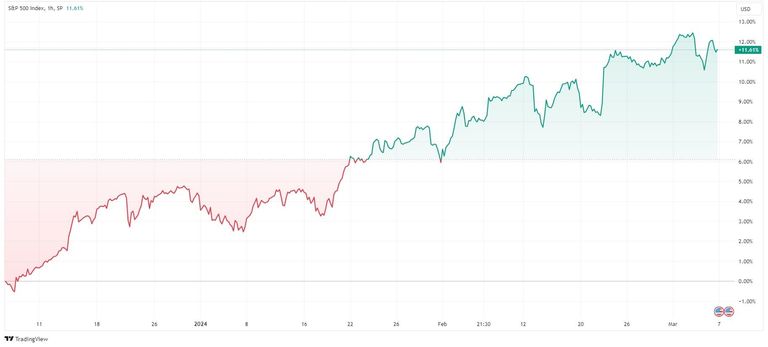

The robust economy and strong job market coincide with a stock market trading near record highs, though it experienced a sharp decline on Tuesday. The rally since late last year, concentrated on big-name tech stocks, is attributed to the potential benefits of the emerging artificial intelligence boom.

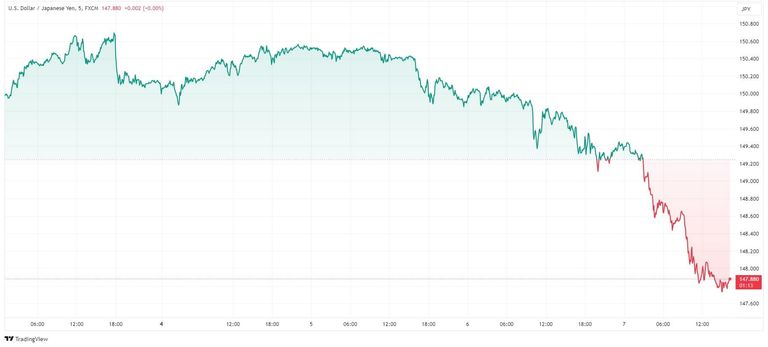

On the other hand, currency markets shed their holdings of the US dollar following Powell’s comments regarding the timeline for interest rate cuts this year. Consequently, on early Thursday, the USD/JPY pair experienced a sell-off, causing the greenback to fall below the ¥148.00 threshold for the first time since February began.

Powell is scheduled to speak again today, this time to the US Senate Committee on Banking, Housing, and Urban Affairs.

Source: Kitco