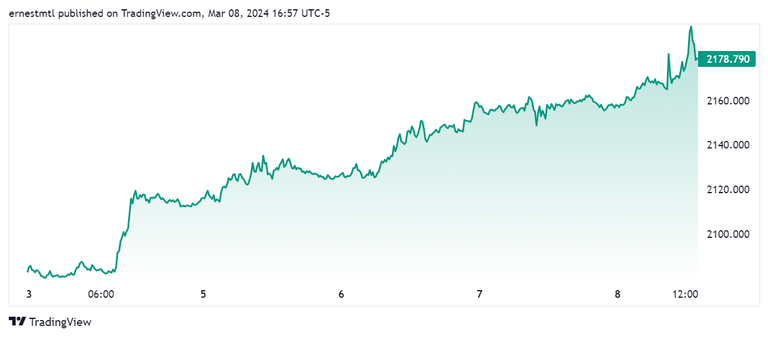

After last Friday’s all-time high for a weekly close, gold picked right up where it left off this week, setting multiple all-time highs in both the spot and futures markets despite Fed Chair Powell’s milquetoast Capitol Hill testimony and parallel all-time highs in equity markets and Bitcoin.

Spot gold kicked off the week trading above $2,080 per ounce, and it never sniffed that level again as it spiked above $2,119 on Monday, $2,135 on Tuesday, $2,150 on Wednesday, and $2,162 on Thursday, before setting the new high-water mark of $2,195.23 shortly after noon EST on Friday.

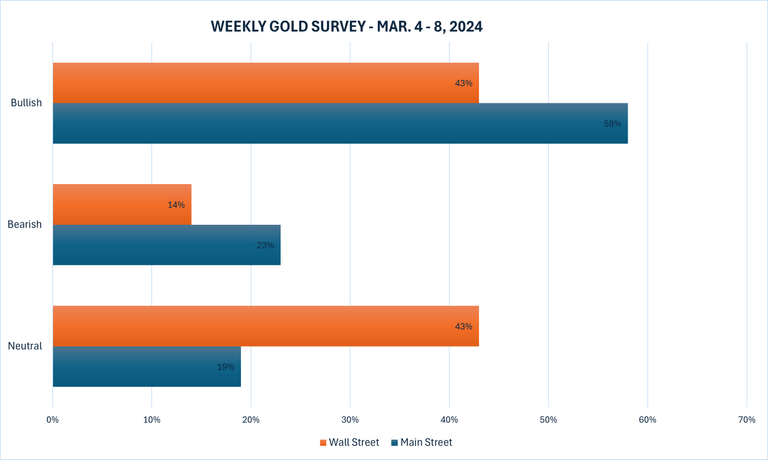

The latest Kitco News Weekly Gold Survey showed this week’s bullish sentiment has fully taken hold on Wall Street and Main Street, with the overwhelming majority of those surveyed in both camps seeing gold gaining or trending sideways next week.

Mark Leibovit, publisher of the VR Metals/Resource Letter, summed up his position on the precious metal’s prospects in four letters: “BULL.”

“Sideways,” said Christopher Vecchio, Head of Futures & Forex at Tastylive.com. “Just buy the dip until the trend changes, and there is no indication that gold’s trend is going to change anytime soon.”

“Up,” predicted Adrian Day, President of Adrian Day Asset Management. “Gold is due for a pause, but the momentum is with gold and new buyers–-other than central banks–are finally entering the market. With the significant underexposure among most investors in the west, both retail and institutional, this move could have legs.”

Ole Hansen, head of commodity strategy at Saxo Bank, was one of the few bearish voices among analysts this week. “Lower next week as the metal is now in serious need of consolidation after rallying well ahead of schedule,” he said.

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes that all signs point to this rally being driven by sovereign buying.

“China is just quietly underpinning the market, adding to the reserves,” he said. “A lot of central bank buying, not only by them, but by others to prop up their currencies. I think that’s still going on. There’s a lot of global uncertainties here, I’ve got to think that’s a big part of it, because equities are at all-time highs and gold is at all-time highs.”

“You do still have geopolitical tensions, but we’ve had geopolitical tensions for years,” he added. “The Ukraine-Russia conflict starting in ’22, obviously the attack against Israel on October 7, the subsequent shutdowns of important sea lanes, attacks on shipping vessels in the Red Sea, in a vital part of the world, and you can’t get crude oil in the 80s for any sustainable period. It just goes to show you where the trades or the investments want to be.”

Lusk said that even with the yellow metal at these unprecedented levels, the trend remains upward. “The path of least resistance is still higher,” he said. “Now we’re above a key level, another high today, we’re busting through some trend lines.”

Lusk added that the integrity of the market itself is coming into question a little bit, especially when everything else is in the red. “You have a ridiculous value in the stock market, you have every other metal in the red, you have energy in the red,” he noted. “You have the dollar only down 9 on the day, but yet you’re up 17 dollars in gold.”

After the yellow metal blew through Walsh Trading’s price target, Lusk said he has reason to believe it could double up on its standout performance.

“$2,175 was our target. I said it’s going to go there because it’s five percent [on the year],” Lusk said. “So does the market have enough juice to get up to $2,278, which is 10 percent higher on the year? April is still the most actively traded contract, and we’re at $2,180, so you’ve still got another 90 to go. But two weeks ago, nobody thought we’d be up at this point, so you really can’t say that it wouldn’t.”

“It could go if we stay up here, so today’s settle is going to be key.”

This week, 14 analysis participated in the Kitco News Gold Survey, and optimism ruled the day on Wall Street. Six experts, or 43%, expected to see higher gold prices next week, with an equal proportion predicting it would trade sideways. Only two analysts, representing 14%, predicted a drop in price for the precious metal.

Meanwhile, 296 votes were cast in Kitco’s online polls, with a strong majority of Main Street investors also predicting further gains for gold. 173 retail traders, representing 58%, looked for gold to rise next week. Another 67, or 23%, predicted it would be lower, while 56 respondents, or 19%, were neutral on the near-term prospects for the precious metal.

U.S. inflation data will once again take center stage as February’s CPI and PPI reports, released Tuesday and Thursday, respectively, will offer market participants one last chance to handicap the Fed’s position ahead of the following week’s FOMC meeting.

Markets will also be watching Thursday’s retail sales report and weekly unemployment claims, and the Friday releases of Empire State manufacturing data and the University of Michigan Consumer Sentiment survey.

Darin Newsom, Senior Market Analyst at Barchart.com, believes a pullback is probably in the cards for gold. “I may be jumping the gun on this a bit, but it looks like April gold could move into a short-term downtrend on its daily chart Friday or early next week,” he said. “Why? The US February jobs data, for what it’s worth, has come and gone. The talking heads will now debate the numbers and revisions for the next month.”

“Fed Chairman Powell has basically said not to expect an interest rate cut at the March meeting of the FOMC (19th and 20th) meaning the US dollar could try to firm for a while,” he added. “Technically, April gold is sharply overbought on its daily chart and in position for stochastics to establish a bearish crossover at Friday’s close. We’ll see what happens.”

Kevin Grady, president of Phoenix Futures and Options, said that after this week’s runaway price action, he wants to wait and see what the inflation data tells him.

“For next week, especially at these prices, I would be neutral,” Grady said. “I think of Powell’s conversations and speech this week. Everything with gold right now seems like it’s interest rate driven.

When Powell comes out and says, ‘Look, we’re not looking to do this too fast, cutting rates, we’re going to take a pause on that,’ you saw that gold took a big dive. So I think there’s a lot of speculation based on the lower interest rates coming in. But I think also, there’s not so much demand in the market. If you look at volume, today the volume is very good. 205,000 contracts, that’s a really good day for gold, it’s a lot of activity, but it’s a lot of speculative trading, a lot of algo trading.”

“I do think that’s what brought people in again, the thought of lower rates coming in.”

Grady said he doesn’t buy the idea that gold’s rally is a bet against sustained strength in equities. “I don’t think so,” he said. “I get it, this has been a fast equity move and everything’s rallying. But if you look at it, the equities are based on earnings and projections on those earnings from companies, and I think that’s what’s driving this move. 83 percent of companies that came in have met or beat expectations on their earnings. This is earnings-driven.”

He added that while he understands why many market participants see the stock market as one big frothy bubble due for correction, he doesn’t believe the recent strength is unsustainable. Quite the contrary.

“The thing is, if you think about it, you don’t have to be a solid investor, you don’t have to be market savvy, and you can right now be getting, four, five percent on your money,” he said. “Everyone’s doing that, and that’s why there’s so much cash on the sidelines. What everyone does is chase yield. As interest rates start coming off and people start losing those high yields, they’re going to have to start turning to equities. With so much cash on the sidelines, that’s why the stock market’s going so fast: There’s not so many people in it.”

“A lot of people think they’re going to just correct. And it may, you may have a correction prior to that, but I think as they start cutting rates, you’re going to see a lot of money flowing back into equities because you’re not going to get five percent yields for doing nothing.”

Grady agreed with the theory that the current rally is largely being driven by central banks buying physical gold. “I think that it’s a definite driver in the market,” he said. “Obviously, the price action attracts trend traders, right? People that are trend followers, they’re attracted by this. So I think the central bank buying did come in, but the trend followers exacerbated this move.”

Looking ahead, Grady sees next week’s CPI and PPI releases as major risk events for gold traders.

“I think it’s dramatic,” he said. “It’s definitely going to move the market, one way or the other. I think what’s moving gold is the prospect of lower interest rates, so everyone’s going to be watching. Is it going to happen in June? Is it going to happen in September? When is it going to happen? When are they looking for the rate cuts? That’s what everyone’s looking for.”

And Kitco Senior Analyst Jim Wyckoff sees only green lights for gold prices next week. “Higher, as technicals are fully bullish.”

Spot gold last traded at $2,178.08 at the time of writing, up 0.83% on the day and 4.58% on the week.

Source: Ernest Hoffman Kitco