Gold prices are trading lower as traders are getting ready for one of the biggest events of the week, which will take place later today. There is no doubt that the gold price staged a remarkable rally last year with a gain of 13% as the Fed dialled down on its dovish hawkish stance and gave market players hopes that things will be different in 2024. This moves the dollar index away from its high and positively influences the price of gold. However, today, we could potentially see some dramatic moves in the gold price, and that is why

Background

Last year, the Fed was under tremendous pressure as inflation reached double digits due to excessive support of monetary and fiscal policies to soften the blow of the COVID crisis. The Fed had no option but to adopt ultra-hawkish monetary policy, and as a result, they began the process of raising the interest rates from their ultra-low levels to their current level of 5.5%. The purpose of this was to slow down economic activity in such a way that it cools inflation and doesn’t create an environment under which the US economy faces a hard landing.

The Fed did a great job of bringing inflation down from its double digit to 3.1% (as of the last reading). However, the number is still running high if one compares it to the Fed’s own inflation target of 2%, and I believe that this is what will be in focus at today’s event.

Today’s Event

Later today, the Fed will release its minutes, and in those minutes, there will be a message that will be dissected by market players to look for clues in relation to the Fed’s next potential policy move. During the last meeting, the Fed Chairman sent a message that made market players believe that the Fed is done with its interest rate hike and that now the process of lowering the interest rate will begin. As always, market players have taken things a little out of context, which spurred a rally in the US stock market and also drove the dollar index lower, which positively influenced the price of gold.

What Could Happen Today?

It is highly possible that today the Minutes will focus on the Fed’s inflation target of 2%, and there could be a message that the market players need to have a reality check if they believe that the Fed is on a dovish monetary policy path. Yes, inflation has come down, but it is still running hot, which means things need to be carefully monitored. A message along these lines would drive the dollar index higher, and gold prices could see a dramatic plunge. However, traders should keep in mind that if you are a trader with a long-term view, this could be an opportunity to bag some bargains as the path of the least resistance for the gold price continues to remain on the upside as the Fed will lower the interest rate, and this is because keeping them at the current level increases the threat of hard lending, which they can certainly not afford.

Price Action

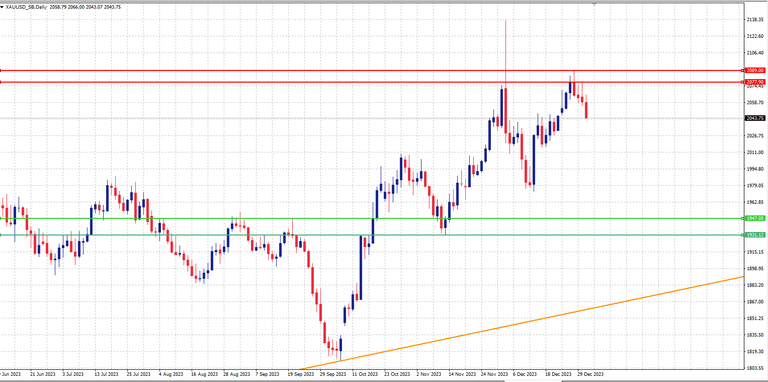

In terms of the price action, the immediate support for the gold price is represented by the green line, which could serve as a buy zone as this is the area where the price bounced back sharply to the upside. So if the Fed pours cold water on lowering interest rate expectations or delivers a reality check to gold traders, the price could drop in this area.

Source: Kitco